WHY NOW?

Why now?

There’s never been a better time to start a business in the UK. With so many new forms of funding available, more and more people are setting up on their own – making the UK the third most popular market in the world for start-ups.

As we’ve uncovered in our 100 Stories of Growth campaign, it’s not for everyone. For some, securing huge sums of capital can be really problematic.

With little experience in the highs and lows of running a business, some entrepreneurs can find themselves responsible for other people’s money without having built up the resilience, experience or support network they need to succeed.

Limited resilience can lead to burnouts, relationship breakdowns, mental health issues and founders being forced out of their own brainchild. It’s clear something needs to change.

Cultural change is needed

The lack of diversity in businesses that secure investment is concerning.

Less than 1% of UK venture funding goes to all-female teams. A major survey last year revealed that two-thirds of women entrepreneurs felt they were not taken seriously when seeking investment.

It’s crucial that investors adopt a more holistic and responsible approach to investing. This requires a cultural shift from within the investment community.

Forward-thinking UK investors can become change agents – benefitting not just entrepreneurs but everyone working for an ambitious UK business.

Working with investors, business leaders and strategic partners, we will create the most inclusive and supportive investor community in the world and help fuel the healthy growth of UK businesses at the same time.

THE TIME IS NOW

It’s never been easier for an entrepreneur to get an idea off the ground as capital continues to flow freely. Entrepreneurial spirit is high and rising, but there are cultural challenges that impact founders and the future of British business.

For small businesses to thrive, the investment community needs to take a more inclusive role in supporting founder mental health and promoting diversity.

25%

of founders said their mental and emotional health has been affected but they’ve suffered in silence.*

53%

said that building their business

has been one of the toughest

times of their lives.*

24%

said that having better relationships with their investors would have helped them personally and professionally.*

13%

of senior people in VC investment teams in the UK are women; 2.5% of teams have no women at all.**

45%

of founders said they’ve felt under constant, extreme pressure running their business.*

89%

of all VC investment in the

UK in 2017 went to all-male

founder teams.**

*Source: 100 Stories of Growth – Insights from Entrepreneurs Report

**Source: UK VC & Female Founders by the British Business Bank, Diversity VC & BVCA

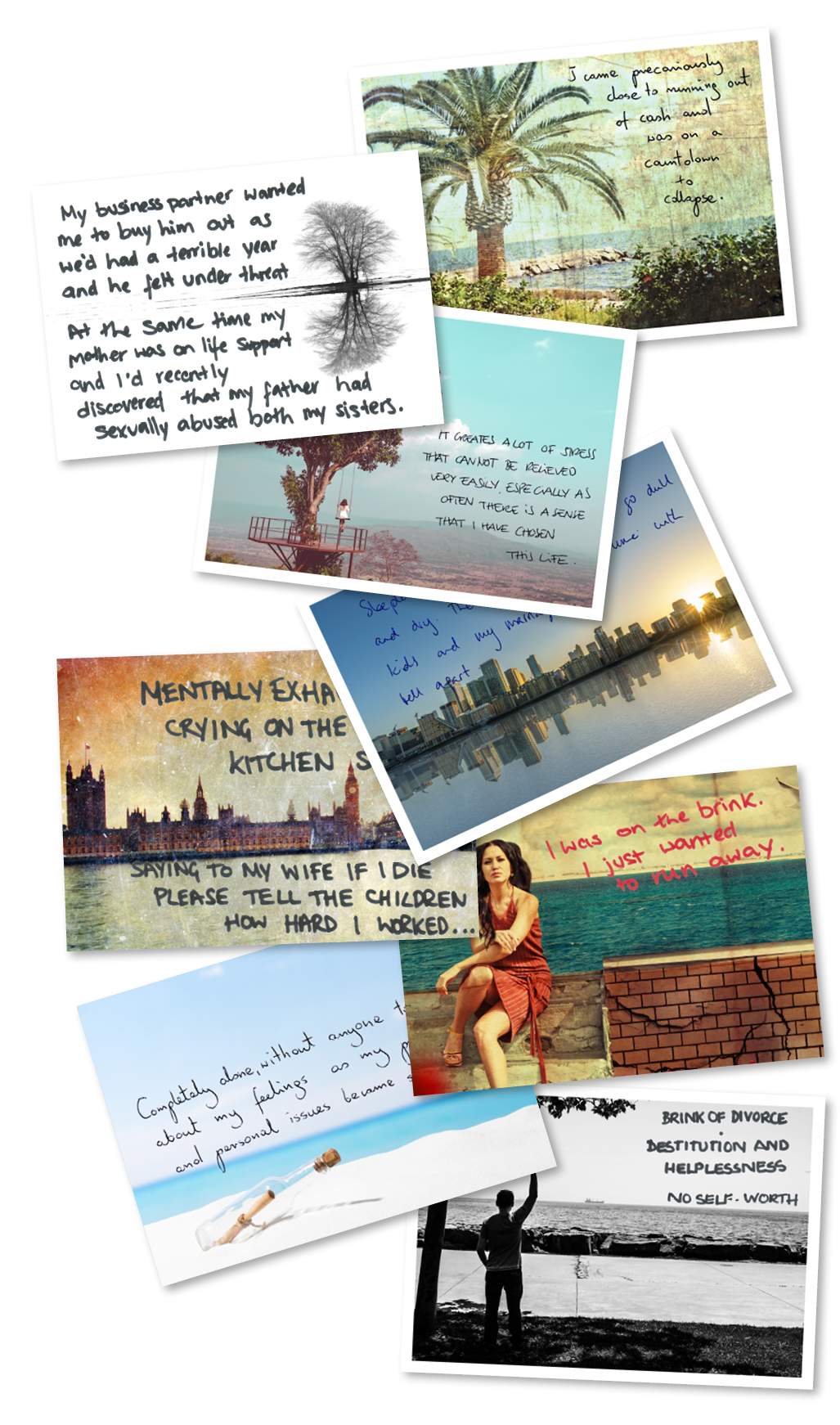

Good mental health, postcards from the heart

Source: 100 Stories of Growth – Insights from Entrepreneurs Report

Four of our entrepreneur advocates have battled mental

and emotional challenges during their journeys:

Become a mindful investor here